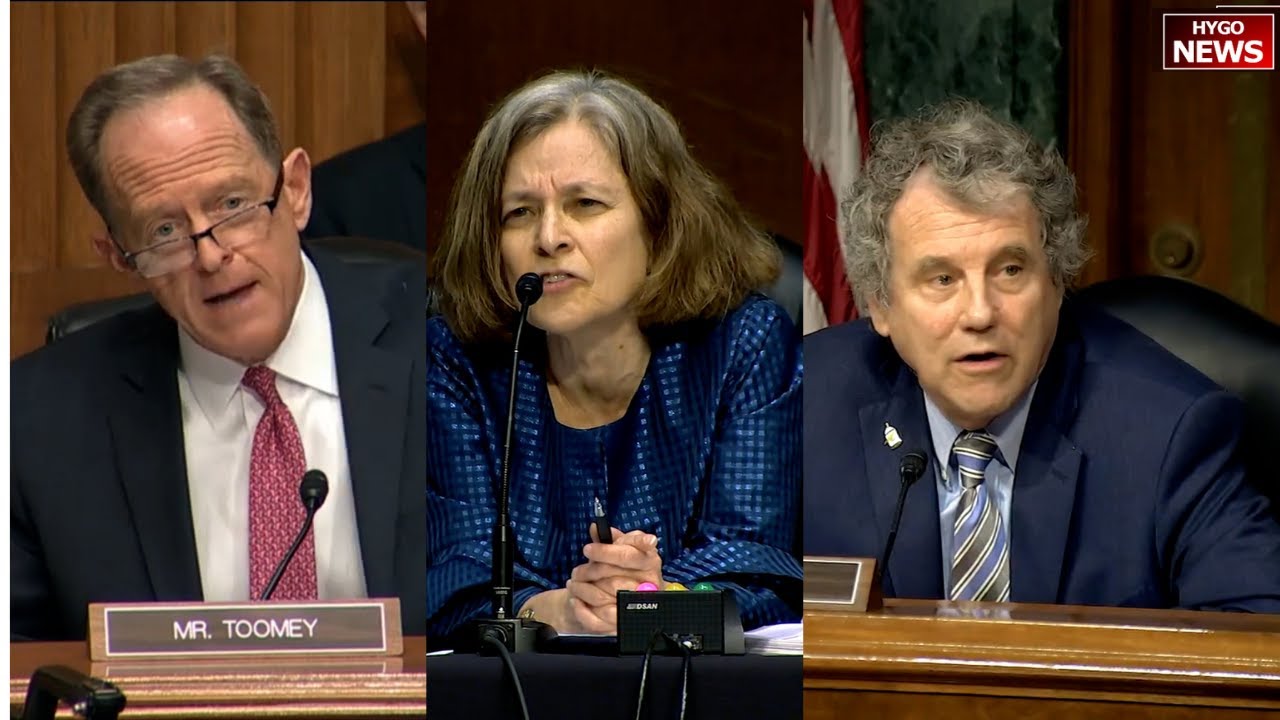

It’s a little bit rich to be lectured by the chairman about not attending a markup of nominees when the chairman personally led the Democratic boycott of the Senate Finance Committee markup of two Trump nominees. There were several other Dems on the Committee who participated in that boycott. I guess what’s good for the goose is not good for the gander. It’s also rich to hear wailing and gnashing of teeth about vacancies on the Fed board and this newfound Dem concern over inflation. First of all, I and my Republican colleagues have been on record for well over a year warning about inflation risk, warning about the excessive spending.

Democrats criticized us for wanting to normalize interest rates and Fed policy. And yet here our Democratic colleagues are pushing for yet another inflation fueling spending blowout bill. The fact is the Fed is fully functional. The FOMC has nine of its 12 members in place. They could raise rates today if they wanted to. They could do it tomorrow. They could do it at any time.

But what’s really ironic is that it’s the chairman’s decision not to move five nominees forward. We made it clear and I made it clear last week to the chairman repeatedly, publicly, and privately. We’re perfectly happy to vote on five of the six nominees. That would be four Fed governors and the director of the FHFA. If we did, actually most of them would get considerable Republican support. They’d move on.

And if there were a concern about vacancies on the Fed, the chairman could fix that very quickly. He chooses not to, he prefers to have the vacancies. That’s his choice. It’s also interesting how some of my Democratic colleagues have been so passionate about ending the revolving door.. Is there a more archetypical example than Ms. Raskin?

The chairman said that the candidates answered the questions. Let me be very clear: Ms. Raskin was far less than candid with us. She failed to disclose that she even was a director of Reserve Trust. She failed to disclose the 1.5 million dollars she made for that service. She failed to disclose hundreds of pages of writing and hours of speeches.

When she was asked how did she get on the board of Reserve Trust in the first place, she said she couldn’t recall. Which is odd because the founder and chairman says in an article in today’s Wall Street Journal that he’s known the Raskins for decades. When Ms. Raskin was asked if she ever contacted the Fed on behalf of Reserve Trust, first she evaded the question repeatedly. But then eventually she replied by saying she couldn’t recall.

Well, that’s funny, because the Kansas City Federal Reserve President recalled the conversation very well. The chairman of Reserve Trust recalled the conversation. He wasn’t even part of it. But we’re supposed to believe that Ms. Raskin just couldn’t recall. And let me remind everybody why this is important. Reserve Trust is a fintech company based in Colorado. And it applied for something that’s extremely valuable: a master account at the Fed. To my knowledge, there’s not a single fintech in America that has gotten that.

And unsurprisingly, they were denied. Their application was turned down. Then, Ms. Raskin who was on the board, called the Fed. And shortly thereafter, the Fed does a 180 degree reversal and approves the master account. To the best of my knowledge, as of today, there’s a grand total of one fintech in America that has a master account with the Fed and it is Reserve Trust. So we asked an obvious question. Why the reversal? Why the 180 degree change? What changed?

First we get stonewalled. Then we finally get a partial answer from the Federal Reserve Bank of Kansas City… My problem with that is on Tuesday night, the Colorado Division of Banking says that’s not true. And this is what they said, “we consider the statement that the division reinterpreted state law as a misrepresentation of our practice.” So it remains entirely unclear what happened here. All we know is that Ms. Raskin was in the middle of it. The firm on whose board she sat applied for a very, very valuable account with the Fed. They were turned down. She intervenes, they get approved, and we can’t get an explanation of what happened here.

Is that fair to all the other fintechs across America that would also like to have master accounts, and they’ve been turned down? How is that fair to anybody?

So, Mr. Chairman, it’s your choice if you want to continue to preclude the possibility of having four nominees from the Fed confirmed and the FHFA Director. We are quite happy to process those nominees. But we want answers before we vote on Ms. Raskin.

Let me just close with a quote justifying a boycott of a recent markup of nominees. And I quote, “by refusing to demand honest transparent information about the business dealings of these nominees the Committee failed to do its job on behalf of the American people.” That is Sherrod Brown, 2/1/2017.

https://facebook.com/HygoNewsUSA/videos/474191551001265/

SeFed has 9 of 12 is fully functional, Dem prefers to have the vacancies, Raskin failed to disclose