youtube

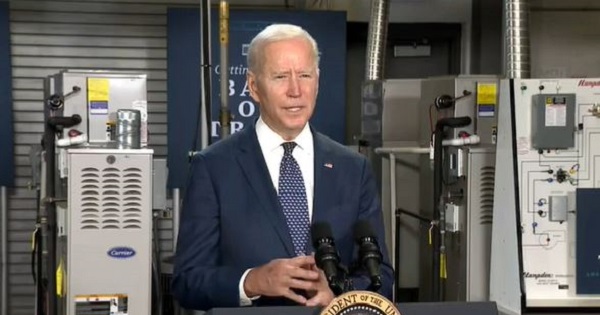

On 5/3/2021, during the Remarks at Tidewater Community College, Joe Biden said, “The reason I’m bothering to do this is I keep hearing out in the press, “Biden is going to raise your taxes.” Anybody making less than $400,000 a year will not pay a single penny in taxes. And we will not increase the deficit either”

By the way, I have to admit: If I didn’t have these positions, I’d be sleeping in the Lincoln bedroom — (laughter) — rather than the Vice — the President’s bedroom. But it really — you know, it really is how to start to transform a life and family and community and our economy: by investing — investing in the people.

For many comments, check out here

Full Transcript

Tidewater Community College, Portsmouth, Virginia 5/3/2021 1:09 P.M. EDT

Biden: My name is Joe Biden. I’m Jill’s husband. (Laughter.) And just like — just like the lovely lady in blue over here is a professor at a community college, my wife also works for your husband. (Laughter.) I — and thank you for the warm welcome today at the airport. Appreciate it very, very much.

And Tim Kaine — one of the great senators and great, great friend.

A guy I’ve relied on most of my career — when I was in the Senate, we worked together; and as Vice President; and now — is Bobby Scott. Bobby, thank you for everything you do. (Applause.)

And Congresswoman Luria — we got to meet when you were in uniform, I think, if I’m not mistaken. And you’re doing a great job, and thank you for being here.

And to all the faculty and the management and the folks here at the community college.

You know, one of the things that — that I really found interesting, Jaiden, is that — the major you took — cybersecurity. We spent a lot of time, as my colleagues in the Congress and the Senate can tell you, worrying and dealing on — with cybersecurity. And it’s really important that — now that we get this under control. And we have the best trained people in the world, and you’re going to be among them.

I’m here today at Tidewater Community College to talk about the America’s Family Plan and — that I announced last week — a once-in-a-generation investment in our families, in our children that addresses what people care most about and most need — the investment we need to win the competition — the competition with other nations for the future. Because we’re in a race. We’re in a race.

It all starts with access to a good education, as you all know. When America made 12 years of public education universal in America in the early 1900s, it made us the best-educated nation in the world, and you saw the benefits that came from that.

But the rest of the world has caught up to us. The rest of the world has caught up to us. They are not waiting. And 12 years is no longer enough to compete with the world in the 21st century and lead the 21st century.

That’s why my American Families Plan guarantees four additional years of public education for every person in America, starting as early as we can.

We were at an elem- — elementary school earlier today. And what we’re talking about here is — it means universal, high-quality preschool for every three- and four-year-olds. Not daycare — preschool. (Applause.)

And the research has shown, here at the great universities in this state and others, that children of that age who go to school — they are far more likely to graduate from high school and continue their education beyond then, rather than start off behind the eight ball if they come from families that are not — don’t have educations — college educations.

You know, a lot of kids start kindergarten hearing a million fewer words having spoken than other families, and it’s an unfair disadvantage. But every child is capable. Every child is capable of learning.

twitter

Biden : “Anybody Making Less Than $400,000 a Year will Not Pay a Single Penny in Taxes” https://t.co/MttRilmULC

— HYGO News (@HygoNews) May 3, 2021

So we just visited, by the way, a fifth-grade classroom in Yorktown earlier today, where the students are back together with their classmates and teachers in school. And we saw what’s — what being in school means for those kids.

Safely reopening the majority of the K-through-8 schools was one of my top priorities in my first 100 days because there’s so much that happens when they don’t have the certitude and the companionship and the familiarity of being with their friends. There’s an awful lot of need in this pandemic for mental health facilities and — and counseling.

And we met that goal by working with the governor here to get educators and school staff vac- — vaccinated and to get them the resources they needed to open up safely.

And I’ve often said that children are the kite strings that keep our national ambitions aloft. We say “all those kids,” but they’re all our children. They’re all our children. And they are the kite strings that literally lift our national ambitions aloft. So we’ve got to invest in them — invest in our children to invest in the future.

And we can’t stop there. We’re going to add two years of community college on top of that. You just heard Jill talk about how community colleges and how it can change lives. Well, students here at the community colleges across the country know why.

For some, it’s two years of community college to earn enough credits to transfer to a four-year university — which is available almost in every single state — to become a teacher, an entrepreneur, or anything else. For some, it’s getting extra training through a certificate program to get a good-paying job and a business in town.

We just met with the students at the HVAC workshop — ambitious, talented students, who are up to taking the next step in their lives. And with the skills they’re learning here — and some of those students will go on to be plumbers and members of the Pipefitters Local 110, electricians — look, it means higher union wages with guaranteed healthcare and pensions.

And, you know, it’s kind of amazing — one of the things — I don’t know if you know — the First Lady of this state understands; she does, I’m positive — that an awful lot of folks who even get an opportunity to go to community college still can’t get there because of food, transportation, and those other costs. And so we’re going to increase Pell Grants so they’ll qualify — (applause) — every — no, it would make a gigantic difference. It’ll make a gigantic difference.

By the way, I have to admit: If I didn’t have these positions, I’d be sleeping in the Lincoln bedroom — (laughter) — rather than the Vice — the President’s bedroom. But it really — you know, it really is how to start to transform a life and family and community and our economy: by investing — investing in the people.

Every child has a capacity to learn. And I’ve — if I’ve heard it once, I’ve heard from Jill a thousand times: “Joe, any country that out-educates us will outcompete us.” And that’s a fact. And she’ll be deeply involved in leading this effort as well.

The second thing: The American Families Plan is going to provide access to quality, affordable childcare, keeping parents — helping parents go back to work, providing a lifeline and benefits for children as they do better in school throughout their lives.

You know, it guarantees low- and middle-income families pay no more than 7 percent of their income for high-quality care for children up to the age of five. And that makes a gigantic difference. There’s millions of women out of work today not because they’re not qualified for the jobs they have, but — they can’t take care of their children and do their job. And the cost of childcare is extraordinary.

I was a single father when I first got elected to the Senate. I had two young boys raised after their mom and sister were killed, and I’ve — had I not had the family I had, I’d never been able to do it. And I’m not joking about that. And I was a senator; I was making a decent salary.

The most hard-pressed working families won’t have to spend a dime if, in fact, my plan works. If you’re low-income folks, you’ll be able to get childcare for free.

Third, the American Families Plan is going to finally provide up to 12 weeks of paid and medical leave — paid family and medical leave. We’re one of the few industrialized countries in the entire world that doesn’t have this feature. No one should have to choose between a job and a paycheck or taking care of themselves, their parent, their spouse, or a child that’s ill. They should have that opportunity.

And the fourth piece of the plan: The American Families Plan puts money directly into the pockets of millions of Americans. In March, we extended the tax credit for low- and middle-income families with children.

Now, if I could hold a second here, what — you know, if you have — make enough money and you’re paying taxes, you end up in a situation where you get to deduct $2,000 per child as a tax benefit. You don’t get it back, but you get to deduct it.

Well, if you’re a minimum-wage worker, you’re not paying much tax. And if you’re making less than that, which many people are, you’re not paying any federal tax. So, you’d get no benefit.

So, we put in place — and a number of my Republican colleagues shared the view too — although none on the voting floor — but they — but I think they share it as well — and that is: Up to $3,000 per child six years and older; and $3,600 for a child that is over six year- — under six years of age. That means two parents and two young kids with — they get a check back from the government for $7,200 in their pockets, which they’re doing now, which can help them take care of your family. And it will benefit more than 65 million children. And all the data shows it will cut child poverty in half this year — cut it in half.

My plan extends the tax credit at least through the year 2025. Because what’s going to happen in 2025, as the press knows, is the tax cuts of the last President expire. And we’re going go back — that put us $2 trillion in debt. And then we’re going to compete as to what tax credits there are. I think it’s about time we start giving tax breaks and tax credits to working-class families and middle-class families instead of just the very wealthy.

And here’s what the American Families Plan doesn’t do: It doesn’t add a single penny to our deficit. It’s paid for by making sure corporate America and the wealthiest 1 percent just pay their fair share.

I come from the corporate capital of the world. More corporations are incorporated in the state of Delaware than all the rest of the nation combined. And I’m not anti-corporate, but it’s about time they start paying their fair share.

It’s about making a choice. You know, we have out there — this year, you had 50 corporations — make, you know, $40 billion — that didn’t pay a single penny in taxes. Not a single penny. I don’t want to punish anybody, but everybody should chip in. Everybody should pay something along the road here.

The choice is about who the economy serves. And so, I plan on giving tax breaks to the working-class folks and making everybody pay their fair share.

Here’s an example of that choice: If you ask the top 1 percent to pay the same tax rate they paid in 2001, when George Bush was President, that would generate $13 billion a year. Now, that’s enough for us to take around $11 [billion] of that $13 billion and provide for two years of community college free for every student in America.

So, what’s fair? Go from 36 to 39.6 percent, like it used to be, and be able to take care of ever- — what’s better? Just — just think about it in terms of what’s better for America — not Democrat, Republican, independ- — what’s going to grow America more? What’s going to grow America more? What’s going to make us more competitive, stronger? What’s going to make us better educated?

So, for folks at home, I’d like to ask a question: Do we want to give the wealthiest people in America another tax cut? Or do you want to give every high school graduate the ability to earn a community college degree on their way to good-paying jobs or on their way to four years of school in industries of the future — healthcare, IT, cybersecurity, you name it?

Look, another example: For too long, we’ve had a two-tiered tax system. Working families pay taxes they owe on the wages they earn, while some of the wealthiest Americans avoid paying anything close to that fair share.

My plan revitalizes and — the capacity of the IRS to crack down on — there’s a number of studies, from the former Secretary of Treasury on, that millionaires and billionaires are able to avoid taxes and cheat in avoiding those taxes because we have so few agents in the IRS.

It’s — the consensus is if you increase the disclosure requirements for banks and financial institutions on accounts for the wealthiest Americans to reduce tax cheating, you will have two steps — two steps would recover $70 billion per year that currently goes unreported and unpaid.

Now — and we’ve been hearing about this for the last 10 years. Instead of cutting a number of agents, we should be increasing the number of agents — not hounding anyone, just being able to get access to information. And shut down all the tax havens from the islands to — anyway, I won’t go into it. I can get a little carried away with this.

But, look — and we can take this money — this money and pay for universal pre-K for every three- and four-year-old in America. So what is better? Making people just pay their fair share. Paid family leave. Childcare costs of working families — maximum of 7 percent of their income.

Again, it’s a choice. It’s more important to shield millionaires from paying their fair share? Or is it more important that every child gets a real opportunity to succeed from an early age and ease the burden on working families?

Third, we have a loophole in our tax system called “stepped-up basis.” It’s also known as the trust fund loophole. For example, if I had a million dollars in stock that I bought and it made a million dollars and I was going to cash it in, I’d have to pay capital gain on that million dollars.

But if, God forbid, on the way — go back to where I was — on the way to where we’re talking about — on the way to cash in my stock, I got hit by a car and got killed, I can leave it to my daughter, and she pays no tax — a tax that was owed two seconds earlier.

It’s not an inheritance tax. It was a tax was owed two — two seconds earlier. But that’s what “stepped-up basis” means. It’s a person passes away and leaves the stock in their — to their son or daughter; son or daughter don’t have to pay anything on that multimillion-dollar gain when they sell that stock. And that’s worth a lot of money.

Look, they may be decent and honorable people — and they are — but the last thing Americans with around — with the amount of wealth — needs is another tax break.

We need to make a choice to eliminate the loophole — only the gains above for people — only the gains above people making $2 million a year — or, excuse me, a couple — a rate of [raise of] capital gains rate for people making more than a million dollars a year, which, by the way, would affect three tenths of 1 percent of all taxpayers — three tenths of 1 percent of the top 1 percent.

And close another loophole, like the real estate investor loophole, where the wealthy is simply paying the same rate on their wages and investment income. That raises $40 billion a year for the next 10 years.

The reason I’m bothering to do this is I keep hearing out in the press, “Biden is going to raise your taxes.” Anybody making less than $400,000 a year will not pay a single penny in taxes. And we will not increase the deficit either, unlike the last gigantic tax cut, which increased the deficit by $2 trillion.

It’s about balancing the system and growing the economy. It means wealthy investors no longer pay lower marginal tax rates than their secretary pays — the secretary in their office.

Do you want to know what that would do? That would take that money and extend the lifechanging middle-class tax cut and put it in place for American Rescue Plan and expand Child Care Tax Credit t- — I mentioned earlier, that’s $1,700 [$7,200] in the pockets of a family with two kids for — now through — through 2025.

Look, just closing these loopholes by taxing investment income at the same rate we — for — as wages for the wealthiest Americans, we’d have enough to extend this again through 2025.

So I ask again: Is it more important to keep these tax loopholes for millionaires — who are good people; they’re not bad folks, but — or would we rather put $7,200 in the pockets of working moms and dads every year if they have two children?

Folks, trickle-down economies — economics has never worked. For too long, we’ve had an economy that gives every break in the world to the folks who need it the least. It’s time to grow the economy from the bottom up and the middle out.

We can choose to give hardworking families a break — a tax break, in effect. We can choose to invest in our students. We can choose an economy that rewards work, not just wealth, and that chooses —

The choice I’m making and the vast majority of the American people support is: Let’s give people a shot. Given even half a chance, the American people have never, ever, ever let their country down. Imagine if we give them a full chance. Imagine what it would mean for them and their families and for our country.

We’re the United States of America. There’s nothing — nothing — we’ve been unable to do when we do it together. So, let’s get together. Let’s get this done. Because the truth of the matter is that we can do this and grow the economy. I won’t — I won’t go into all the other statistics, but the plan is estimated to grow the economy another trillion dollars. This will grow the economy. Everybody would be better off.

So, I want to thank you all for doing your part here to make sure that not only you’re educating and giving people a real shot — a real shot at a real life, consistent with their talents and their capacities; not limited because they don’t have the money. And we’re going to give it to a lot more people.

I promise you — I promise you: America will be much stronger for it. Because, like I said, if we’re setting out a universal education, it wouldn’t just be 12 years anymore. It would be — it would be those 14 years — 16 years I’m talking about: 2 to start, and 2 at the other end.

And as your state has done under your governor and your senator and your congresspersons, your state — if you got — if you get four years out of here — two — two years out here, that’s two years towards a co- — a state university. You cut tuition in half for a four-year degree as well.

So there’s an awful lot of possibilities, an awful lot of hope. And the good news is I think there’s overwhelming, bipartisan support for this. You look at the polling data: Republican voters overwhelmingly support it. Now I just got to get some of my Republican colleagues to support it.

So, thank you all, and God bless you. And thank you for the work you’re doing. And may God protect our troops. Thank you so much. (Applause.)

Q Mr. President, when do you think the U.S. will reach herd immunity? When do you believe the U.S. will reach herd immunity?

Biden: I think, by the end of the summer, we’ll be in a very different position than we are now. As you know, I’ve worked very hard to make sure we have over 600 million doses of vaccine.

We’re going to continue to make sure that’s available. We’re going to increase that number across the board as well so we can also be helping other nations once we take care of all Americans.

And what’s happening now is all the talk about how people were not going to get shots, they were not going to be involved — look at what that was — we were told that was most likely to be among people over 65 years of age. But now people over 65 years of age, over 80 percent, have now been vaccinated, and 66 percent fully vaccinated. And there’s virtually no difference between white, Black, Hispanic, Asian American.

And so — because what we’ve done, under some criticism, is we have expanded access to vaccinations to familiar places — 40,000 drugstores now. Also, all of the Community Health Centers that are available all across the nation. Mobile units going out. And it’s getting better and better and better. And so that’s why we’re leading the world.

When I got elected, I said, in the first 100 days, we’d get 100 million people vaccinated. I was wrong; we got 230 million vaccinated. (Applause.)

I think — I think you’ll see — and there’s a debate, you know — and I’ll end with this — there’s a debate on what constitutes herd immunity. “Is it 70 percent of the population? Is it 68 percent? Is it 81 percent?”

The point is that, by the end of the summer — right now, every single person, 16 years or older, doesn’t have to wait in line — can show up and get a vaccination now. My plea to everyone: Get vaccinated now please.

Thank you. (Applause.)

1:31 P.M. EDT