Witness: Well, there’s a congressional ban on unreasonable credit card penalties. When the rules were implemented over a decade ago, there was a loophole which the credit card industry’s lawyers have driven a truck through, to the tune of $10 billion a year. I think junk fees are a huge problem in our economy.

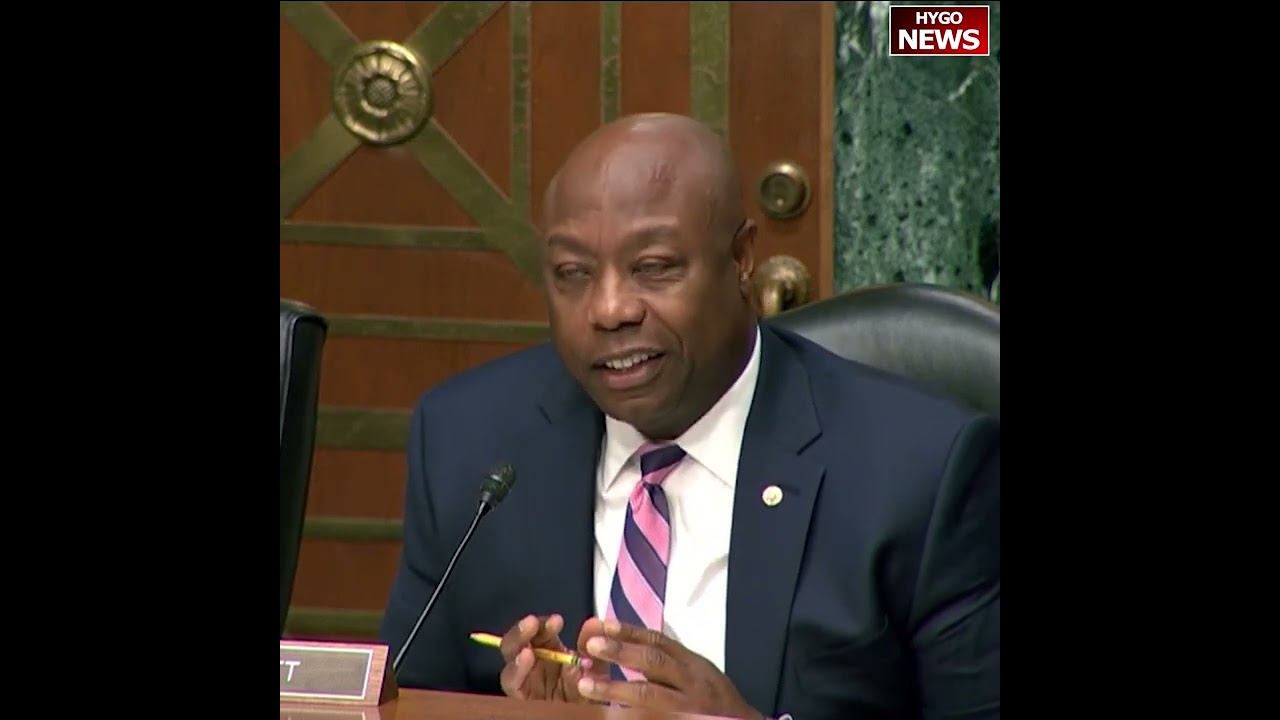

Scott: I would simply say that, uh, having, uh, speaking with Fort Dong is common in the Biden administration, number one. Number two, I would simply say this as my time is running out according to the Chairman’s red button: I wish we had congressional bans on the IRS charging late fees and interest on balances due. I wish we had a consistent standard applied to the public sector as we do the private sector. We’d probably have a better, better, better outcome.

In the opening statement, Senator Scott said, “Just like the CFPB’s civil investigative demands – or CID – process.

Under your CID process, the bureau may issue, without any court order, a

subpoena to a business when you are “looking into potential violations of

the law. And once that subpoena has been issued, the CFPB can demand nearly

anything they want, from reems of documents to executive testimony. “

Ranking Member Scott Questions at CFPB Hearing – June 12, 2024

Civil Investigative Demand (CID)

https://www.facebook.com/HygoNewsUSA/videos/423999133788707

Senator: Why are late fees okay for IRS but not okay for businesses? Civil Investigative Demand (CID) without court order