While speaking at a Senate Banking Committee hearing on Capitol Hill — testifying for the first time since the Supreme Court upheld the constitutionality of the federal agency’s funding structure — Consumer Financial Protection Bureau Director Rohit Chopra cited reports about JPMorgan Chase and PayPal’s plans to use sensitive customer data on income and spending for “surveillance-based targeting.”

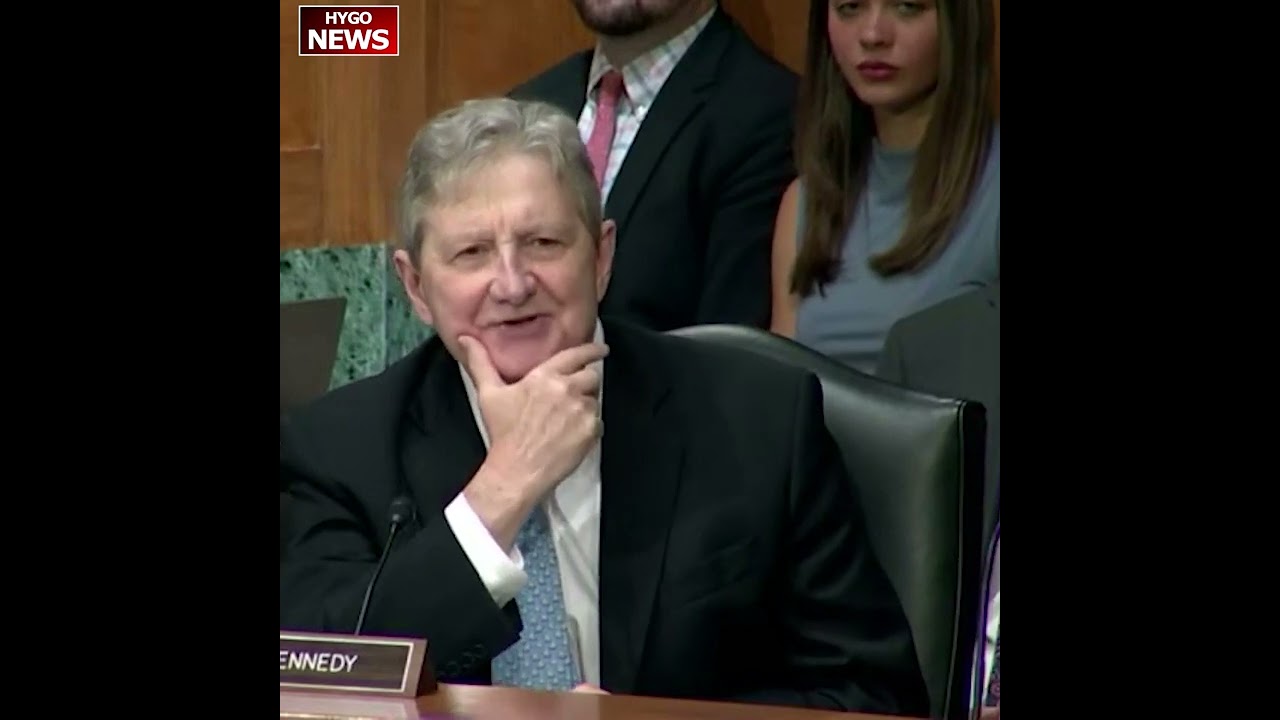

Sen. John Kennedy, R-LA, pointed out that the CFPB’s funding comes from the transfers made by the Federal Reserve Board from the combined earnings of the Federal Reserve system. Since September 2022, however, the Fed has not generated any earnings, operating at a loss. “How are you entitled to any money right now? The Federal Reserve doesn’t have any earnings,” Kennedy asked the CFPB director.

These arguments center around the fact that the CFPB’s funding structure violates the Constitution’s separation-of-powers principle because the money comes from the Federal Reserve, not Congress. Chopra, for his part, dismissed the claims. “I can tell you we’ve looked at this issue. We do believe wholeheartedly everyone is complying with the statute,” Chopra said.

The CFPB is only allowed under Dodd-Frank to be funded out of “combined earnings of the Federal Reserve System” and that there has been no combined earnings of the Federal Reserve System beginning in September, 2022. Senator John Kennedy (R-LA) grilled CFPB Director Rohit Chopra to distinguish revenues from earnings and explain how the CFPB is entitled to money when the Federal Reserve has no earnings right now.

https://www.facebook.com/HygoNewsUSA/videos/804568794979889

Kennedy: Federal Reserve Has No Earnings, JPMorgan Chase & PayPal sensitive data